Videos for Economics of

Investments

The bulk of videos for this course are actually voice-over slides

covering material in the Coursepack. You can link to these videos from

the course Blackboard site. There are a number of videos and films to

which you can link from this page that might be helpful to you in this

course. Some of these are made by professionals, some by amateurs and

even a few starring myself. But, sadly, high-end popular educational

films in finance, especially derivatives, that gets film buffs all

abuzz really aren't particularly common.

Videos on Options and

Black Scholes

Some students in this course are likely not to have seen the

Black-Scholes model in prior classes. Here are two videos that I made

with Gianpiero Alicchio and Allegra Sappio of LUISS that introduce just

the non-technical basics of these topics. So, if you read about these

topics in the Coursepack and are having problems, start be having a

look at these videos. Bear in mind that I am based in New York, while

Gianpiero and Allegra are in Rome, so there are still a few minor

glitches in the videos. Partly because of these glitches, I recommend

that you see the notes below before or while you view the videos.

John Teall - The

Black-Scholes Options Pricing Model

https://vimeo.com/351000132/6a9d6fa53a

|

This

video introduces the important Black-Scholes Options Pricing Model to

the valuation of simple "plain vanilla" stock options, calls and puts.

|

|

The

following are notes that might be helpful to you when viewing the

video. I recommend pausing the video during the times listed in the far

left to pay attention to the notes towards the center and right:

|

|

Time

|

S0

= 75

|

X

= 80

|

T = .5

|

s2

= .16

|

rf

= .10

|

s

= .4

|

c0

= ?

|

|

|

Underlying

|

Exercise

|

Expiration

|

Underlying

|

Riskless

|

Underlying

|

Call

|

|

1:24-1:27

|

Price

|

Price

|

Date

|

Return

|

Return

|

Standard

|

Price

|

|

|

|

|

|

Variance

|

Rate

|

Deviation

|

|

|

2:16-22

|

The

Black-Scholes Model is in the box on the right. We will fill in the

values from the left of the video into the box.

|

|

2:22-33

|

Starting

with the equation for d1, we fill in values, finding that d1

= 0.09. Then, we fill in values for d2, finding that d2

= -0.1928 (the equals sign before it is missing).

|

|

2:43-2:53

|

Next,

we get the N(d1) and N(d2) values from a z-table. Since

different z-tables handle areas to the left of the mean differently,

under the normal curve the value .5 might or might not be added or

subtracted from the value at the appropriate intersection of row and

column. But, each table will be consistent from example to example.

|

|

2:58-3:06

|

Now,

insert the N(d1) and N(d2) into the c0 equation

to complete the calculation.

|

|

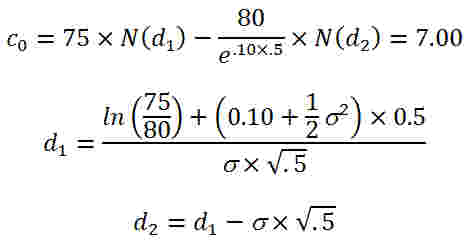

3:19-3:47

|

Don't

stop the video. Instead, look at the following equation:

Also,

I

made a mistake at time = 3:26, saying "minus" when I should have said

"plus."

|

John Teall - Implied

Volatility

https://vimeo.com/351001396/65adcc8764

This

video applies the Black-Scholes Option Pricing Model to the calculation

of underlying stock (or asset) variances based on option (or equity)

market prices.

The

following are notes that might be helpful to you when viewing the

video. I recommend pausing the video during the times listed in the

left to pay attention to the notes towards the center and right:

|

2:49-3:17

|

|

T = .5

|

r = .10

|

c0 =

7.00

|

X = 80

|

S0 = 75

|

|

|

If

investors use the Black-Scholes Options Pricing Model to value calls,

the following should be expected:

|

|

|

3:21-3:32

|

Just

compare what is written above to what is on the screen. Notice that the

calculated call price c0 = 7.958

> 7.00 is too high. We will need to try again with a lower standard

deviation

estimate.

|

Instructional Videos

that Correspond to our Derivatives Sessions

Running a course online through Zoom or Blackboard can be dreadful for

a lot of reasons. Students often find reading long dense pdf files

about banking to be even more dreadful. In an effort to make some part

of this material more palatable to students, I propose that you

consider watching a few fairly well-made films for some comic relief.

It is not essential that students view any of the following videos if

they are able to read and fully comprehend the Coursepack. The videos

just might be more enjoyable for some students and may make it easier

to fully understand the material in the Coursepack for some.

Unfortunately, the videos will certainly not cover all of the material

required for exam purposes. Some of the videos below are well-made and

entertaining, which might help students stick with their efforts a

little longer. In case problems arise due to your url, firewalls and

the like, multiple links are provided for most videos.

Trillion Dollar Bet (2000):

This documentary tells a story of the Black-Scholes-Merton options

pricing formula and the collapse of hedge fund Long-Term Capital

Management (LTCM). It includes interviews with Robert Merton and Myron

Scholes, who won the Nobel Prize in Economics in 1997. Some of the

stories involving academics are true, some are a little misleading.

Some are dead-on right, such as the story told by Paul Samuelson

concerning Louis Bachelier and the discussion of Itô

Calculus. The "dark side" stories of the narrator seem to reflect a

lack of knowledge trading and financial modeling, but no real harm

done, but many of the descriptions of basic options are pretty

good. The video omits discussion well-known and visually similar

formulas that existed at the time developed by Sprenkle and Samuelson.

The key insight of the Black-Scholes-Merton formulations is the dynamic

hedge ratio, as discussed in the film. There are striking similarities

between the failure of resolution of LTCM and the Financial Crisis of

2008. One insightful quote at the end, by Paul Samuelson, citing Albert

Einstein: "Elegance is for tailors." This would be a wonderful film for

the right finance course. Available for free, as of April 2020 at https://watchdocumentaries.com/trillion-dollar-bet/, https://docur.co/documentary/trillion-dollar-bet, https://archive.org/details/TrillionDollarBet

and https://vimeo.com/244903345.

Panic: The Untold Story of the 2008

Financial Crisis: Full VICE Special Report: Excellent HBO

documentary detailing the events leading up to the failure of Lehman

Brothers. Available on HBO-Go and, as of April 2020, available on

Youtube at https://www.youtube.com/watch?v=QozGSS7QY_U,

https://topdocumentaryfilms.com/panic-untold-story-2008-financial-crisis/,

https://www.youtube.com/watch?v=wyz79sd_SDA,

and https://www.forbes.com/sites/rogervaldez/2019/05/26/must-watch-the-untold-story-of-the-2008-financial-crisis/#6db2da982352.

Most of these web pages have a connection to Youtube.

Films and Videos that Might

be a Little Bit Instructional in a Derivatives Course, but Likely to be

More Entertaining

While many of the

films on this list were popular, their educational value might

questionable, or at least aren't quite relevant to our course.

Nevertheless, they might be more entertaining than the Coursepack. I

have not looked at films closer to the bottom of the list. All of these

films are available online somewhere, but many will probably require

some sort of subscription to view. Links to free sites are provided

where available.

Trading Places (1983): A rather

silly comedy starring Eddie Murphy that actually stands out among

popular films concerning finance and financial trading. While, for the

most part, the film is downright silly, it does include some dramatic

and even somewhat realistic depictions of a number of important

concepts crucial to traders. There were real parallels between actual

trading and the trading action in the film. It might be worth looking

online to list how others have listed some of the parallels between the

film and actual trading floors. Some observers have suggested that the

film was inspired by a real-life social experiment of trading partners

William Eckhardt and Richard Dennis, who sought to learn whether

successful trading could be taught.

The Ascent of Money (2008) In

this 6-part documentary, based on a book with the same title, Niall

Ferguson, author and academic, traces the evolution of money, bond

markets, insurance, bubbles, the subprime mortgage debacle, etc. A key

lesson from this video is the same as what historians regularly remind

us: This time is not so different; it has happened before — and

more than once. Has applications to Sessions 2 and 7. At least three of

the 6 parts are available through PBS online at https://www.pbs.org/video/the-ascent-of-money-part-1-from-bullion-to-bubbles/,

https://www.pbs.org/video/the-ascent-of-money-part-2-bonds-of-war/,

and https://www.pbs.org/video/the-ascent-of-money-part-3-risky-business/.

It appears that all 6 segments are available at https://www.youtube.com/watch?v=fsrtB5lp60s.

Floored (2009): A documentary

by the trader James Allen Smith is instructional and might be of

interest to students, but doesn't really intersect with material

covered in our particular course. This documentary concerns the decline

of the Chicago Trading Pits and traders' responses and efforts to adapt

to electronic trading.

Growth of the Finance Industry

(2019): Narrated by Philip Short, this 8-part series of 12-minute

segments chronicles the past 100 years of the development of Shanghai's

banking and financial industries. Free with Amazon Prime, and

approximately $6 for all 8 parts through Amazon (paid; free with Amazon

Prime) at https://www.amazon.com/Growth-Finance-Industry/dp/B07HFJHS6Z.

Inside Job (2010): Documentary

concerning the Financial Crisis of 2008.

Rogue Trader (1999): Acted

film based on Nick Leeson and Barings Bank.

The Big Short (2015)

In 2006-2007 a group of investors bet against the US mortgage market.

In their research they discover how flawed and corrupt the market is.

The Flaw (2011) 78 minute

analysis of the financial crisis

Updated 05/23/2022