Videos for Economics of

Derivatives

The bulk of videos for this course are actually voice-over slides

covering material in the Coursepack. You can link to these videos from

the course Canvas site. I provide links here to a few videos that we'll

use in our course, but there is not enough storage space on my site for

all of my videos. Thus, you'll also need to use the course Canvas

platform for most of the course.

Chapter

1: Video to accompany Chapter 1 of the Coursepack

Chapter

2, Part 1: Video to accompany Chapter 2, Part 1 of the Coursepack

Chapter

2, Part 2: Video to accompany Chapter 2, Part 2 of the Coursepack

Chapter

3: Video to accompany Chapter 3 of the Coursepack

There are a number of other videos and films to which you can link

from this page that might be helpful to you in this course. Some of

these are made by professionals, some by amateurs and even a few

starring myself. But, sadly, high-end popular educational films in

finance, especially derivatives, that gets film buffs all abuzz really

aren't particularly common.

Remedial Videos on Black

Scholes

Some students in this course are likely not to have seen the

Black-Scholes model in prior classes. Here are two videos that I made

with Gianpiero Alicchio and Allegra Sappio of LUISS that introduce just

the non-technical basics of these topics. So, if you read about these

topics in the Coursepack and are having problems, start be having a look

at these videos. Bear in mind that I am based in New York, while

Gianpiero and Allegra are in Rome, so there are still a few minor

glitches in the videos. Partly because of these glitches, I recommend

that you see the notes below before or while you view the videos.

John Teall - The Black-Scholes

Options Pricing Model

https://vimeo.com/351000132/6a9d6fa53a

|

This

video

introduces the important Black-Scholes Options Pricing Model to

the valuation of simple "plain vanilla" stock options, calls and

puts.

|

|

The

following

are notes that might be helpful to you when viewing the video. I

recommend pausing the video during the times listed in the far

left to pay attention to the notes towards the center and right:

|

|

Time

|

S0

= 75

|

X

= 80

|

T

= .5

|

s2

= .16

|

rf

= .10

|

s

= .4

|

c0

= ?

|

|

|

Underlying

|

Exercise

|

Expiration

|

Underlying

|

Riskless

|

Underlying

|

Call

|

|

1:24-1:27

|

Price

|

Price

|

Date

|

Return

|

Return

|

Standard

|

Price

|

|

|

|

|

|

Variance

|

Rate

|

Deviation

|

|

|

2:16-22

|

The

Black-Scholes

Model is in the box on the right. We will fill in the values

from the left of the video into the box.

|

|

2:22-33

|

Starting

with

the equation for d1, we fill in values, finding that

d1 = 0.09. Then, we fill in values for d2,

finding that d2 = -0.1928 (the equals sign before it

is missing).

|

|

2:43-2:53

|

Next,

we

get the N(d1) and N(d2) values from a z-table. Since

different z-tables handle areas to the left of the mean

differently, under the normal curve the value .5 might or might

not be added or subtracted from the value at the appropriate

intersection of row and column. But, each table will be

consistent from example to example.

|

|

2:58-3:06

|

Now,

insert

the N(d1) and N(d2) into the c0 equation

to complete the calculation.

|

|

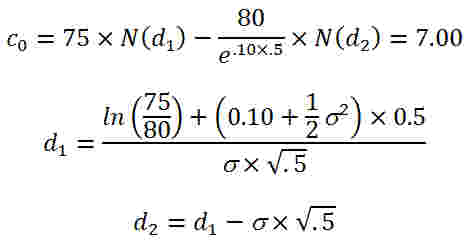

3:19-3:47

|

Don't

stop

the video. Instead, look at the following equation:

Also,

I

made

a mistake at time = 3:26, saying "minus" when I should have said

"plus."

|

John Teall - Implied

Volatility

https://vimeo.com/351001396/65adcc8764

This

video

applies the Black-Scholes Option Pricing Model to the calculation of

underlying stock (or asset) variances based on option (or equity) market

prices.

The

following

are notes that might be helpful to you when viewing the video. I

recommend pausing the video during the times listed in the left to pay

attention to the notes towards the center and right:

|

2:49-3:17

|

|

T

= .5

|

r

= .10

|

c0

= 7.00

|

X

= 80

|

S0

= 75

|

|

|

If

investors

use the Black-Scholes Options Pricing Model to value

calls, the following should be expected:

|

|

|

3:21-3:32

|

Just

compare

what is written above to what is on the screen. Notice that the

calculated call price c0 =

7.958 > 7.00 is too high. We will need to try again with a

lower standard deviation

estimate.

|

Instructional Videos that

Correspond to our Derivatives Sessions

Running a course online through Zoom or Blackboard can be dreadful for a

number of reasons. Students often find reading long dense pdf files about

banking to be even more dreadful. In an effort to make some part of this

material more palatable to students, I propose that you consider watching a

few fairly well-made films for some comic relief. It is not essential that

students view any of the following videos if they are able to read and fully

comprehend the Coursepack. The videos just might be more enjoyable for some

students and may make it easier to fully understand the material in the

Coursepack for some. Unfortunately, the videos will certainly not cover all

of the material required for exam purposes. Some of the videos below are

well-made and entertaining, which might help students stick with their

efforts a little longer. In case problems arise due to your url, firewalls

and the like, multiple links are provided for most videos.

Trillion Dollar Bet (2000): This

documentary tells a story of the Black-Scholes-Merton options pricing

formula and the collapse of hedge fund Long-Term Capital Management (LTCM).

It includes interviews with Robert Merton and Myron Scholes, who won the

Nobel Prize in Economics in 1997. Some of the stories involving academics

are true, some are a little misleading. Some are dead-on right, such as the

story told by Paul Samuelson concerning Louis Bachelier and the discussion

of Itô

Calculus. The "dark side" stories of the narrator seem to reflect a lack of

knowledge trading and financial modeling, but no real harm done, but

many of the descriptions of basic options are pretty good. The video omits

discussion well-known and visually similar formulas that existed at the time

developed by Sprenkle and Samuelson. The key insight of the

Black-Scholes-Merton formulations is the dynamic hedge ratio, as discussed

in the film. There are striking similarities between the failure of

resolution of LTCM and the Financial Crisis of 2008. One insightful quote at

the end, by Paul Samuelson, citing Albert Einstein: "Elegance is for

tailors." This would be a wonderful film for the right finance course.

Available for free, as of April 2020 at https://watchdocumentaries.com/trillion-dollar-bet/,

https://archive.org/details/TrillionDollarBet

and https://vimeo.com/244903345.

Panic:

The Untold Story of the 2008 Financial Crisis: Full VICE Special

Report: Excellent HBO documentary detailing the events leading up

to the failure of Lehman Brothers. Available on HBO-Go and, as of April

2020, available on Youtube at https://www.youtube.com/watch?v=QozGSS7QY_U

and https://topdocumentaryfilms.com/panic-untold-story-2008-financial-crisis/.

Most of these web pages have a connection to Youtube.

Films and Videos that Might be a

Little Bit Instructional in a Derivatives Course, but are More Likely

to Simply be Entertaining or Instructional for Some Other Finance

Course

While many of the

films on this list were popular, their educational value might

questionable, or at least aren't quite relevant to our course.

Nevertheless, they might be more entertaining than the

Coursepack. I have not looked at films closer to the bottom of

the list. All of these films are available online somewhere, but

many will probably require some sort of subscription to view.

Links to free sites are provided where available.

Trading

Places (1983): A rather silly comedy starring Eddie Murphy that

actually stands out among popular films concerning finance and financial

trading. While, for the most part, the film is downright silly, it does

include some dramatic and even somewhat realistic depictions of a number of

important concepts crucial to traders. There were real parallels between

actual trading and the trading action in the film. It might be worth looking

online to list how others have listed some of the parallels between the film

and actual trading floors. Some observers have suggested that the film was

inspired by a real-life social experiment of trading partners William

Eckhardt and Richard Dennis, who sought to learn whether successful trading

could be taught.

Floored (2009): A documentary by

the trader James Allen Smith is instructional and might be of interest to

students, but doesn't really intersect with material covered in our

particular course. This documentary concerns the decline of the Chicago

Trading Pits and traders' responses and efforts to adapt to electronic

trading.

Growth of the Finance Industry

(2019): Narrated by Philip Short, this 8-part series of 12-minute segments

chronicles the past 100 years of the development of Shanghai's banking and

financial industries. Free with Amazon Prime, and approximately $6 for all 8

parts through Amazon (paid; free with Amazon Prime) at https://www.amazon.com/Growth-Finance-Industry/dp/B07HFJHS6Z.

Inside Job (2010): Documentary

concerning the Financial Crisis of 2008.

Rogue Trader (1999): Acted film

based on Nick Leeson and Barings Bank.

The Big Short (2015) In

2006-2007 a group of investors bet against the US mortgage market. In

their research they discover how flawed and corrupt the market is.

The Flaw (2011) 78 minute analysis

of the financial crisis

Updated 01/23/2025