Corporate and Investment

Banking Videos

There are a number of videos and films that might be helpful to

you in this course, some made by professionals, some by amateurs and

even a few starring myself. But, sadly, high-end popular educational

films in finance that gets film buffs all abuzz really aren't

particularly common.

Introductory Video to View Prior to the Course Start

This video will

introduce the course, CIB, with a focus on its syllabus: cibIntro.mp4.

Remedial Videos for the First

and Second Sessions

In previous offerings of this course, some students have struggled

with certain topics, particularly those related to cryptocurrency and to

the Black-Scholes options pricing model. Some students have not seen the

Black-Scholes model in prior classes. Here are four videos that I made

with Gianpiero Alicchio and Allegra Sappio of LUISS that introduce just

the basics of these topics. So, if you read about these topics in the

Coursepack and are having problems, have a look at the videos. Bear in

mind that I am based in New York, while Gianpiero and Allegra are in

Rome, so there are still a few minor glitches in the videos. Partly

because of these glitches, I recommend that you see the notes below

before or while you view the videos.

Session 1:

John Teall - MBA - 4 - Cryptocurrency,

Distributed Ledgers and Blockchains

https://vimeo.com/351197360/789a2fab92

This

video

discusses blockchains, distributed ledgers and cryptocurrency.

Before viewing this video, read pp.7-10, which are part of Section B

in Chapter 1 of the Coursepack, available at http://www.jteall.com/cib01.pdf.

Session 2:

John Teall - MBA - 1 - The

Black-Scholes Options Pricing Model

https://vimeo.com/351000132/6a9d6fa53a

|

This

video

introduces the important Black-Scholes Options Pricing Model to

the valuation of simple "plain vanilla" stock options, calls and

puts.

|

|

Before

viewing

this video, read pp. 26-29 of the Appendix to Chapter 3 of the

Coursepack, available at http://www.jteall.com/cib03.pdf.

The following are notes that might be helpful to you when

viewing the video. I recommend pausing the video during the

times listed in the far left to pay attention to the notes

towards the center and right:

|

|

Time

|

S0

= 75

|

X

= 80

|

T

= .5

|

s2

= .16

|

rf

= .10

|

s

= .4

|

c0

= ?

|

|

|

Underlying

|

Exercise

|

Expiration

|

Underlying

|

Riskless

|

Underlying

|

Call

|

|

1:24-1:27

|

Price

|

Price

|

Date

|

Return

|

Return

|

Standard

|

Price

|

|

|

|

|

|

Variance

|

Rate

|

Deviation

|

|

|

2:16-22

|

The

Black-Scholes

Model is in the box on the right. We will fill in the values

from the left of the video into the box.

|

|

2:22-33

|

Starting

with

the equation for d1, we fill in values, finding that

d1 = 0.09. Then, we fill in values for d2,

finding that d2 = -0.1928 (the equals sign before it

is missing).

|

|

2:43-2:53

|

Next,

we

get the N(d1) and N(d2) values from a z-table. Since

different z-tables handle areas to the left of the mean

differently, under the normal curve the value .5 might or might

not be added or subtracted from the value at the appropriate

intersection of row and column. But, each table will be

consistent from example to example.

|

|

2:58-3:06

|

Now,

insert

the N(d1) and N(d2) into the c0 equation

to complete the calculation.

|

|

3:19-3:47

|

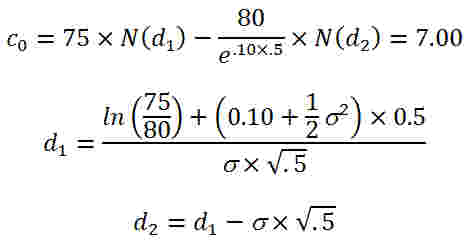

Don't

stop

the video. Instead, look at the following equation:

Also,

I

made

a mistake at time = 3:26, saying "minus" when I should have said

"plus."

|

John Teall - MBA - 2 - Corporate

Securities as Options

https://vimeo.com/346202567/6c1543a740

This

video

applies the Black-Scholes Option Pricing Model to the valuation of

corporate stock and bond securities.

Before

viewing

this video, read pp.3-10, Sections D and E in Chapter 3 of the

Coursepack, available at http://www.jteall.com/cib03.pdf.

If you haven't done so already, you might also wish to read pp. 26-29 of

the Appendix to Chapter 3 of the Coursepack, available at http://www.jteall.com/cib03.pdf.

The video introducing the Black-Scholes Option Pricing Model at https://vimeo.com/351000132/6a9d6fa53a

might also be helpful.

The

following

are notes that might be helpful to you when viewing the video. I

recommend pausing the video during the times listed in the left to pay

attention to the notes towards the center and right:

John Teall - MBA - 3 - Implied

Volatility

https://vimeo.com/351001396/65adcc8764

This

video

applies the Black-Scholes Option Pricing Model to the calculation of

underlying stock (or asset) variances based on option (or equity) market

prices.

Before

viewing

this video, read pp. 26-29 and p. 32 of the Appendix to Chapter 3 of the

Coursepack, available at http://www.jteall.com/cib03.pdf.

The video introducing the Black-Scholes Option Pricing Model at https://vimeo.com/351000132/6a9d6fa53a

might also be helpful.

The

following

are notes that might be helpful to you when viewing the video. I

recommend pausing the video during the times listed in the left to pay

attention to the notes towards the center and right:

|

2:49-3:17

|

|

T

= .5

|

r

= .10

|

c0

= 7.00

|

X

= 80

|

S0

= 75

|

|

|

If

investors

use the Black-Scholes Options Pricing Model to value

calls, the following should be expected:

|

|

|

3:21-3:32

|

Just

compare

what is written above to what is on the screen. Notice that the

calculated call price c0 =

7.958 > 7.00 is too high. We will need to try again with a

lower standard deviation

estimate.

|

Instructional Videos that

Correspond to CIB Sessions

Running a course online through Webex can be dreadful for a number of

reasons. Students often find reading long dense pdf files about banking to

be even more dreadful. In an effort to make some part of this material more

palatable to students, I propose that you consider watching a few fairly

well-made films for some comic relief. It is not essential that students

view any of the following videos if they are able to read and fully

comprehend the Coursepack. The videos just might be more enjoyable for some

students and may make it easier to fully understand the material in the

Coursepack for some. Unfortunately, the videos will certainly not cover all

of the material required for exam purposes. Some of the videos below are

well-made and entertaining, which might help students stick with their

efforts a little longer. In case problems arise due to your url, firewalls

and the like, multiple links are provided for most videos.

Session 1: How

The Federal Reserve Works (And Who Really Owns It): A 9-minute

instructional video discussing the background and structure of the U.S.

Federal Reserve System. Available at https://www.youtube.com/watch?v=-Y0I-vVLBVQ

and https://medium.com/bc-digest/the-federal-reserve-14e077bc94c0.

The first minute and the last minute of the video aren't useful.

Session 1: The

Medieval Bank, the Medici and the Church! Economics!: This video by

Nick Barksdale is more focused than the Coursepack on medieval banking

operations of paramilitary orders such as the Knights of Templar, and does

not discuss matters such as usury, early pawn brokers, etc. in much detail.

Nevertheless, it is a decent introduction to medieval banking on the Italian

peninsula. Link to it at https://www.youtube.com/watch?v=DVmNa52Qpwc.

Session 1: The

Ascent of Money (2008) In this 6-part, 4-hour documentary, based on

a book with the same title, Niall Ferguson, author and academic, traces the

evolution of money, bond markets, insurance, bubbles, the subprime mortgage

debacle, etc. A key lesson from this video is the same as what historians

regularly remind us: This time is not so different; it has happened before

and more than once. The film has applications to Sessions 2 and 7. At least

three of the 6 parts are available through PBS online at https://www.pbs.org/video/the-ascent-of-money-part-1-from-bullion-to-bubbles/,

https://www.pbs.org/video/the-ascent-of-money-part-2-bonds-of-war/,

and https://www.pbs.org/video/the-ascent-of-money-part-3-risky-business/,

and on New York's PBS affiliate, Channel 13, for example, https://www.thirteen.org/programs/the-ascent-of-money/the-ascent-of-money-the-ascent-of-money-episode-2-bonds-of-war/.

It appears that all 6 segments are available at https://www.youtube.com/watch?v=fsrtB5lp60s

and probably elsewhere. This 4-hour film overlaps much of the content of

Session 2, covers a lot interesting information not in Chapter 2 (e.g., John

Law, stock market bubbles, the birth of the Amsterdam Stock Exchange) and

omits some important material in the Coursepack (e.g., details on usury).

Another nicely made video, a more general discussion of money, its functions

andi ts history is available at https://www.pbs.org/video/in-money-we-trust-ox6o7a/.

This lat video highlights the opinions of a number of "gold bugs."

Session 2: Trillion

Dollar Bet (2000): This documentary tells a story of the

Black-Scholes-Merton options pricing formula and the collapse of hedge fund

Long-Term Capital Management (LTCM). It includes interviews with Robert

Merton and Myron Scholes, who won the Nobel Prize in Economics in 1997. Some

of the stories involving academics are true, some are a little misleading.

Some are dead-on right, such as the story told by Paul Samuelson concerning

Louis Bachelier and the discussion of Itτ

Calculus. The "dark side" stories of the narrator seem to reflect a lack of

knowledge trading and financial modeling, but no real harm done, but

many of the descriptions of basic options are pretty good. The video omits

discussion well-known and visually similar formulas that existed at the time

developed by Sprenkle and Samuelson. The key insight of the

Black-Scholes-Merton formulations is the dynamic hedge ratio, as discussed

in the film. There are striking similarities between the failure of

resolution of LTCM and the Financial Crisis of 2008. One insightful quote at

the end, by Paul Samuelson, citing Albert Einstein: "Elegance is for

tailors." This would be a wonderful film for the right finance course.

Available for free, as of April 2020 at https://watchdocumentaries.com/trillion-dollar-bet/, https://docur.co/documentary/trillion-dollar-bet, https://archive.org/details/TrillionDollarBet

and https://vimeo.com/244903345.

Session 3: Panic:

The Untold Story of the 2008 Financial Crisis: Full VICE Special

Report: Excellent HBO documentary detailing the events leading up

to the failure of Lehman Brothers. Available on HBO-Go and, as of April

2020, available on Youtube at https://www.youtube.com/watch?v=QozGSS7QY_U,

https://topdocumentaryfilms.com/panic-untold-story-2008-financial-crisis/,

https://www.youtube.com/watch?v=wyz79sd_SDA,

and https://www.forbes.com/sites/rogervaldez/2019/05/26/must-watch-the-untold-story-of-the-2008-financial-crisis/#6db2da982352.

Most of these web pages have a connection to Youtube.

Session 4: (Also Session

2): Goldman Sachs at 150

(2019): This 150 minute documentary by Ric Burns and paid for by Goldman

Sachs as a sort of 150th birthday present for itself, chronicles the history

of Goldman since 1869. The documentary is split up into 10 segments

averaging 15 minutes each. By paying close attention to detail, someone who

knows nothing about investment banking can learn quite a lot from this

video. Be aware that the film does omit from its history accountings of a

variety of ethics violations and allegations, charges and convictions of

crimes directed at the firm and employees, including fraud, insider trading,

price manipulation, etc. The series of videos does become a bit more

propaganda-oriented in later segments.The video is available on Amazon (free

for Amazon Prime members or about USD 6 for all 10 episodes at https://www.amazon.com/Goldman-Sachs-at-150/dp/B07R7XHDRF.

Better yet, the film is free for everyone with each of the 10 separate

segments available on Youtube (e.g., https://www.youtube.com/watch?v=wonEywOwpEo

and https://www.youtube.com/watch?v=qoCT-h18-ls).

The

video is also available for free in each of its 10 segments from Goldman

Sachs itself at https://www.goldmansachs.com/our-firm/history/goldman-sachs-at-150/.

For a somewhat more negative and very biased historical view of the firm,

have a look at Goldman Sachs CNBC

Documentary: Trading Techniques of an Investment Bank, available at

https://www.youtube.com/watch?v=59ZjK5xPdy8.

Session 4: Initial

Public Offering (IPO) Explained: This just-under 5-minute

video prepared by Citadel Securities and maintained on the Investopedia

website does a nice job providing a short explanation explaining the process

of bringing an IPO to the market. Link to it at https://www.investopedia.com/terms/i/ipo.asp.

A second video, called How do IPOs Work,

even shorter at less than 3 minutes, also brought to you by Citadel

Securities and Investopedia, focuses on the IPO price-setting process on the

NYSE is available at: https://www.investopedia.com/articles/investing/080613/road-creating-ipo.asp.

The page on which the video provides a clear and very simple introduction to

IPOs. A third and even shorter video, also provided by Investopedia, The

Pros And Cons Of A Company Going Public, is available at https://www.investopedia.com/ask/answers/what-does-going-public-mean/.

Films and Videos that Might be a

Little Bit Instructional, but Likely to be More Entertaining

While many of the

films on this list were popular, their educational value might

questionable, or at least aren't quite relevant to our course.

Nevertheless, they might be more entertaining than the

Coursepack. I have not looked at films closer to the bottom of

the list. All of these films are available online somewhere, but

many will probably require some sort of subscription to view.

Links to free sites are provided where available.

Trading

Places (1983): A rather silly comedy starring Eddie Murphy that

actually stands out among popular films concerning finance and financial

trading. While, for the most part, the film is downright silly, it does

include some dramatic and even somewhat realistic depictions of a number of

important concepts crucial to traders. There were real parallels between

actual trading and the trading action in the film. It might be worth looking

online to list how others have listed some of the parallels between the film

and actual trading floors. Some observers have suggested that the film was

inspired by a real-life social experiment of trading partners William

Eckhardt and Richard Dennis, who sought to learn whether successful trading

could be taught.

The Ascent of Money (2008) In this

6-part documentary, based on a book with the same title, Niall Ferguson,

author and academic, traces the evolution of money, bond markets, insurance,

bubbles, the subprime mortgage debacle, etc. A key lesson from this video is

the same as what historians regularly remind us: This time is not so

different; it has happened before and more than once. Has applications to

Sessions 2 and 7. At least three of the 6 parts are available through PBS

online at https://www.pbs.org/video/the-ascent-of-money-part-1-from-bullion-to-bubbles/,

https://www.pbs.org/video/the-ascent-of-money-part-2-bonds-of-war/,

and https://www.pbs.org/video/the-ascent-of-money-part-3-risky-business/.

It appears that all 6 segments are available at https://www.youtube.com/watch?v=fsrtB5lp60s.

Floored (2009): A documentary by

the trader James Allen Smith is instructional and might be of interest to

students, but doesn't really intersect with material covered in our

particular course. This documentary concerns the decline of the Chicago

Trading Pits and traders' responses and efforts to adapt to electronic

trading.

Growth of the Finance Industry

(2019): Narrated by Philip Short, this 8-part series of 12-minute segments

chronicles the past 100 years of the development of Shanghai's banking and

financial industries. Free with Amazon Prime, and approximately $6 for all 8

parts through Amazon (paid; free with Amazon Prime) at https://www.amazon.com/Growth-Finance-Industry/dp/B07HFJHS6Z.

Inside Job (2010): Documentary

concerning the Financial Crisis of 2008.

Rogue Trader (1999): Acted film

based on Nick Leeson and Barings Bank.

Wall Street (1987): Acted film

starring Michael Douglas and Charlie Sheen loosely inspired by Ivan Boesky

and his insider trading activities.

Too Big to Fail (2011): Acted film

based on the book by Andrew Ross Sorkin starring William Hurt, Edward Asner

and Paul Giamatti chronicling the events surrounding the 2008 failure of

Lehman Brothers, somewhat focused on Paulson. Available through HBO-GO and

Amazon.

Goldman Sachs CNBC Documentary: Trading

Techniques of an Investment Bank (2014): For a somewhat negative

and biased historical view of Goldman Sachs, have a look at this

documentary, available at https://www.youtube.com/watch?v=59ZjK5xPdy8.

Wizard of Lies (2017): Acted film

chronicling the Bernie Madoff scam and its aftermath.

Margin Call (2011): Fictional

thriller that follows the key people at an investment bank over a 24-hour

period during the early stages of the 2008 financial crisis.

The Wolf of Wall Street (2013):

Drama based on the life of Jordan Belfort, from his rise to a wealthy

stock-broker living the "fast lane" to his downfall.

Introduction to Banking (2016):

Cartoon made by Bank Audi. A 4-minute introduction to banking for the

utterly clueless. Available at https://vimeo.com/143839648

Boiler Room (2000) A college

dropout, attempting to live up to his father's high standards, gets a job

as a broker for a suburban investment firm which puts him on the fast

track to success. But the job might not be as legitimate as it first

appeared to be.

The Big Short (2015) In

2006-2007 a group of investors bet against the US mortgage market. In

their research they discover how flawed and corrupt the market is.

Wall Street: Money Never Sleeps

(2010) Now out of prison but still disgraced by his peers, Gordon Gekko

works his future son-in-law, an idealistic stock broker, when he sees an

opportunity to take down a Wall Street enemy and rebuild his empire.

Capitalism: A Love Story (2009):

A Michael Moore examination of the social costs of corporate interests

pursuing profits at the expense of the public good.

Other People's Money (1991) :

Comedy

American Psycho (2000): A

wealthy New York City investment banking executive, Patrick Bateman, hides

his alternate psychopathic ego from his co-workers and friends as he

delves deeper into his violent, hedonistic fantasies.

The Company Men (2010): The

story centers on a year in the life of three men trying to survive a round

of corporate downsizing at a major company - and how that affects them,

their families, and their communities.

Glengarry Glen Ross (1992): More

focused on real estate than finance.

The Corporation (2003)

Documentary that looks at the concept of the corporation throughout recent

history up to its present-day dominance.

Wall Street Warriors (2006 ) An

HD documentary series examining the extreme power and intense competition

that defines Wall Street, seen through the eyes of those who thrive there.

Dealers (1989): The London

branch of Whitney Paine, a major American investment bank, is in the midst

of a crisis; after the loss of $100 million, one of their leading traders,

Tony Eisner commits suicide

The Bank (2001) The Bank is a

thriller about banking, corruption and alchemy.

Why Are We All in Debt? (2009):

26 minute documentary asks: How come we are all in debt? An Islamic

finance author and former bond-derivatives dealer Tarek El Diwany. He

points out that according to conventional wisdom, both the disease and the

cure of the financial crisis are the same: On the one hand, we are told

that our financial crisis is the result of too much debt. But then we are

told that the solution is that the banks lend more. How can that be?

The Last Day of Lehman Brothers

(2009) 60 minute film on the bankruptcy of Lehman Brothers.

Investment Banking (2011) 32

minutes on investment banking

The Flaw (2011) 78 minute analysis of the financial crisis

Chasing Madoff (2010): Stock

Market Scam

The China Hustle (2018): Finance

& Trade Documentary

Banking On Bitcoin (2017):

Financial Markets Documentary

Freakonomics (2010): A

collection of filmed economics-related documentaries exploring human

nature from the perspective of an economist and using statistical analysis

to explain phenomena and their causes.

Updated 04/13/2021